Difference between WACC and IRR

Two important sections of financial management include the cost of capital and the analysis of an investment. While investment analysis offers you techniques to evaluate profitability and feasibility of a project, the cost of capital helps you calculate the difference sources of capital. While Internal Rate of Return (IRR) is a technique used in the investment analysis, Weighted Average Cost of Capital (WACC) is used to calculate the cost of capital.

IRR is mostly used in capital budgeting, and it makes up the Net Present Value (NPV) using all the cash flows from a particular project and making them zero. In simple words, it is the rate of growth that a particular project is expected to make. On the other hand, WACC is the expected future cost of a fund. You are asked to assign weights to the company’s debts and its capital and then you get an answer in terms of proportion you have given to these two sources of earning capital.

These two concepts, together, help a financial analyst make a decision for a project.

Instructions

-

1

IRR

IRR is the Internal Rate of Return. It is a tool which is used in financial analysis to help you calculate the attractiveness of different investments you have made. Once you calculate the IRR, you are then asked to choose from the projects you have invested on as you get to know about the ones which are profitable and others that are not. In this technique, the NVP (Net Present Value) of all the cash flows in a project are made equal to zero and then it calculates the growth of a project or an investment, through which you can easily know whether you should invest in it or not. The project with the highest IRR is mostly considered and it is selected by the financial analyst.

Image Courtesy: thegreenlightdistrikt.com

-

2

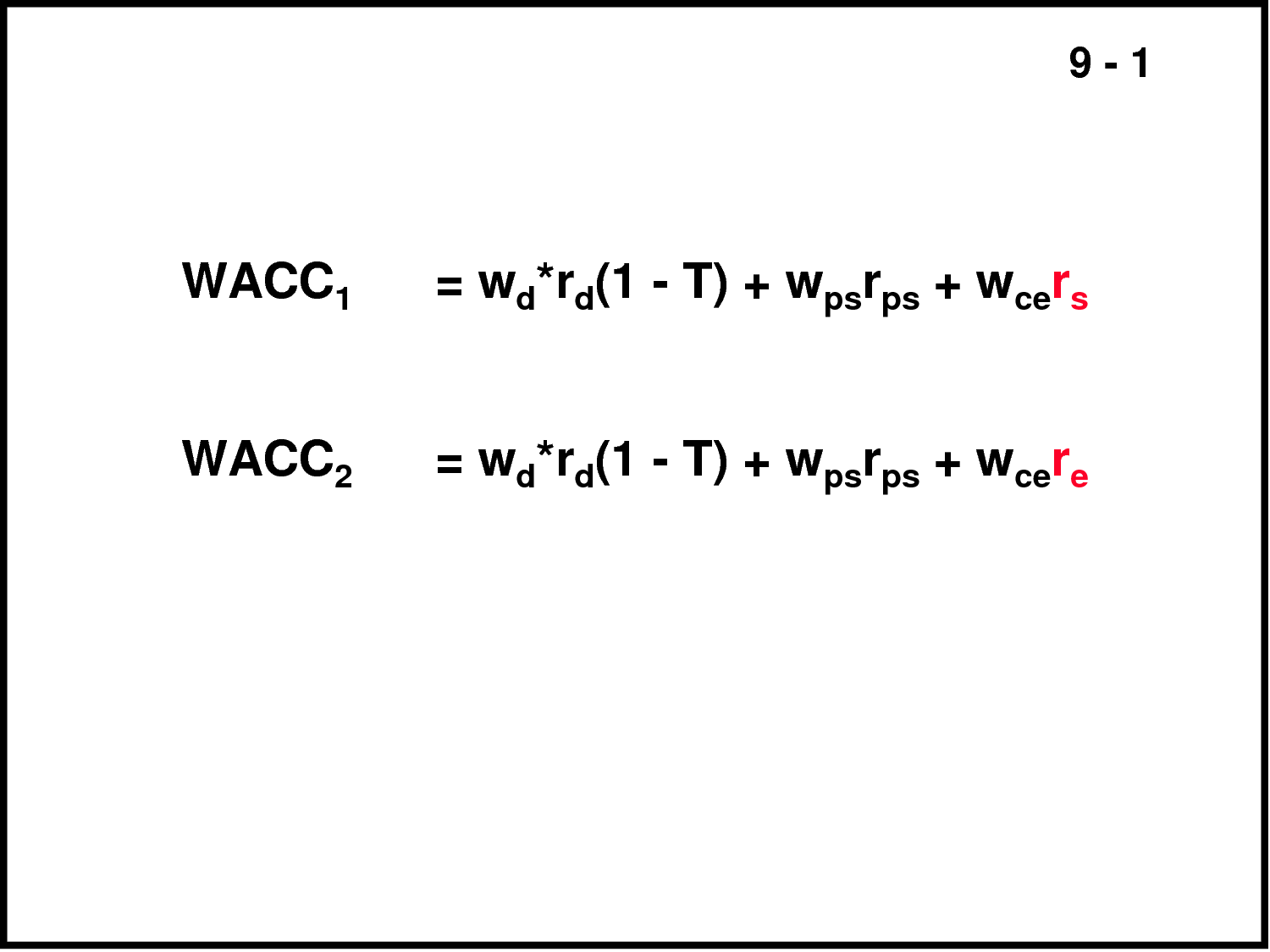

WACC

WACC is the Weighted Average Cost of Capital. Compare to the usual cost of capital, WACC is a tad bit difficult and complicated. You are supposed to calculate the average future costs of all the funds in your company, whether they have been generated from within the organisation or with the help of debts. WACC can help you take a decision about your debt and equity financing and whether you should opt for one or the other. The main formula for calculating WACC is:

WACC = (E / V) × Re + (D / V) × Rd × (1 – Tc)

E = Market value of equity

D = Market value of debt

V = E + D

Re = Total cost of equity

Rd = Total cost of debt

Tc = Tax rate applied to the company

Image Courtesy: thedocstoc.com