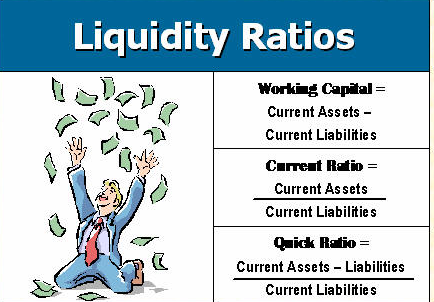

How To Calculate Liquidity Ratios

Liquidity ratios help a company analyze its ability to pay off short-term obligations. The higher value of the ratio suggests that company has readily cash available or higher liquidity level to cover and meet its short-term requirements.

Commonly known liquidity ratios include current ratio, operating cash flow ratio and quick ratio. These ratios are of greater significance for the creditors who want to estimate the company’s ability to pay their debts.

Instructions

-

1

Current Ratio – it is considered as the least conservative ratio as it simply tells you whether the business has enough current assets to meet the payments which are due within a year. It indicates the firm’s market liquidity. The formula for calculating current ratio is – Current Assets/ Current Liabilities.

Although the ratio varies from business to business, having a current ratio between 1 and 3 is healthy for the business. You do not need to keep hold of too much cash but need to have enough to encourage others to invest in your company, knowing that their money is safe.

For instance, if the current ratio is 1:1, it means that the business has $ 1 assets to cover for $1 liabilities. For some industries, the ratio is lower as they can turn over their inventories quickly when compared with accounts payable. -

2

Quick Ratio or Acid Test ratio or Quick Assets ratio: it refers to the company’s ability to pay the creditors with its most liquid assets. It is more conservative than the current ratio as it does not take into account inventory. Companies tend to exclude inventory when they have difficulty in converting it to cash on an immediate basis. The ratio gives a better estimation of a company’s liquidity when compared to the current ratio.

The general equation of quick ratio is – (Current Assets – Inventories)/ Current Liabilities

Higher the ratio suggests that the company has liquid assets at its disposal but generally it is best to have a ratio of 1:1, which refers to the fact that company is not wasting its income by retaining it. -

3

Cash Ratio- it is the most conservative of liquidity ratios which apart from inventories, further excludes accounts receivable from the equation. The latter is not included as the company does not know when their customers will pay back.

The basic equation incorporates cash and short-term marketable securities - Cash + Short-term securities/ Current Liabilities.

It is not ideal for companies to have a cash ratio of 1:1 as it suggests that they are holding too much. Therefore a cash ratio will generally be less than one.