How to Calculate Return on Equity Ratio

The ability to do calculations is something that can help in just about every aspect of our lives. It is even more crucial when it comes to our finances. One can calculate something as simple as a budget for monthly expenses to something diverse and important to calculating one for a multinational organisation.

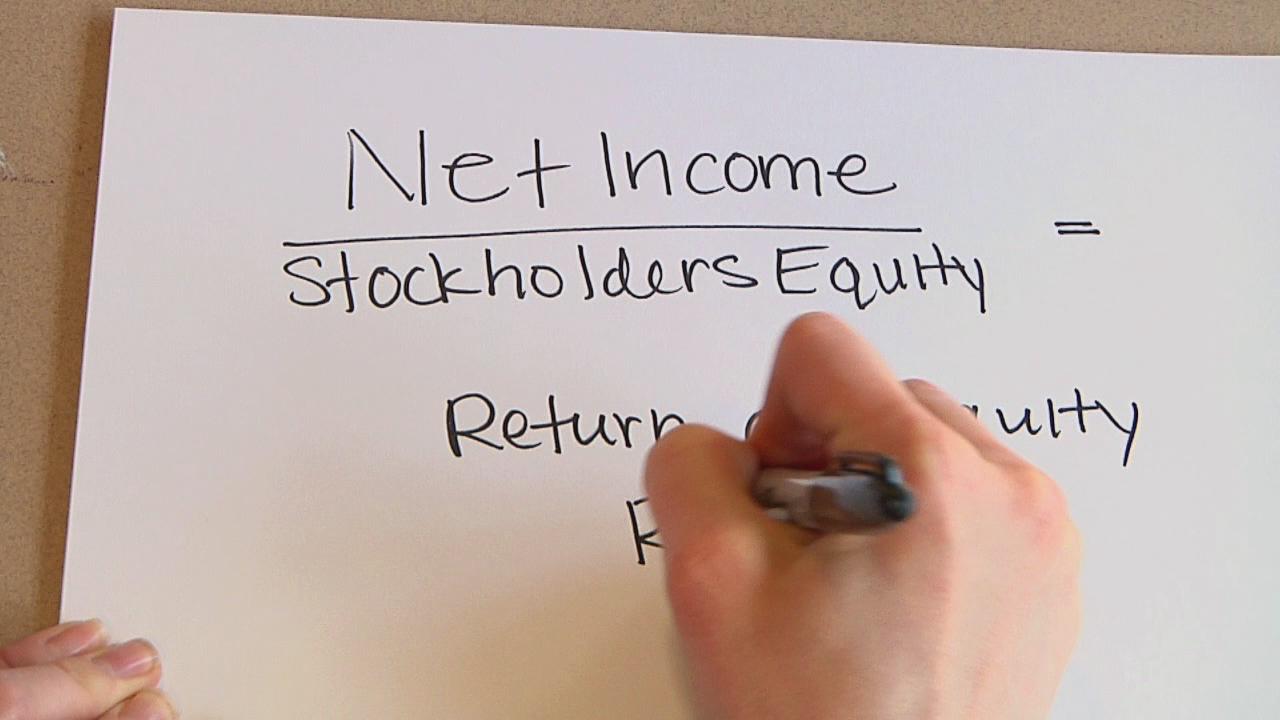

One of the important ratios to calculate in business is the return on equity ratio. It gives you a glimpse of how much return has been acquired on the owner’s equity and whether the investment is bearing enough fruit or not.

Instructions

-

1

Calculate Shareholder’s Equity

The first thing to do is to calculate the shareholders equity in the company. This is a pretty simple calculation and you can simply do it by subtracting the total liabilities from total assets. The total assets include total share capital, preferred shares and various other assets. It is important that the assets as well as liabilities are calculated properly in order to get an accurate figure on the basis of which we will move forward in the process. -

2

Calculate Average Shareholder’s Equity

To calculate the average shareholder’s equity, we add the shareholder’s equity from the previous year and add it to the current shareholder’s equity and divide the sum by two. This will give us the average shareholder’s equity. -

3

Net Profit

Check out the company’s annual financial reports to see the net profits. Remember that net profit is the figure of profit that has been ascertained after the taxes have been paid. If you have the figure of profit which is before the payment of taxes to the government, it is gross profit and will not give you an accurate picture of the overall profitability and thus your figure of return on equity will be inaccurate and not reliable. -

4

Calculate Return on Investment

This is the last step that we take. We apply a simple formula where we divide the net profit from the average shareholder’s equity. The resulting figure gives us the return on equity ratio. This will guide you well if your investment has been sound or if you are looking to make an investment, will it be fruitful or not.