How to Calculate Economic Profit or Loss

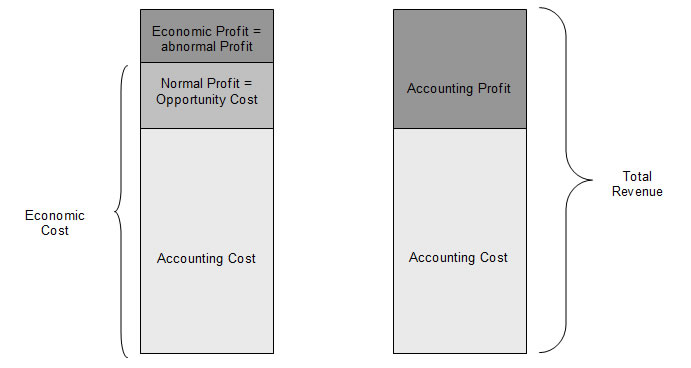

Economic profits of a business are usually referred to as economic value added (EVA), which is the financial gains or loses a company generates after taking into account opportunity cost. It differs from the accounting method as the company calculates profits by considering the impact of other alternatives which have been foregone. Economic profits are usually hard to calculate as you cannot accurately estimate the profits other ventures may have given, had you pursued them.

Instructions

-

1

In simple terms there are three components to analyze. Revenue is the amount of money generated by the company through the sale of its product and services. Expenses are the cost it has incurred in the production of a particular product and service, which is split into operating, fixed etc. While this is the explicit cost, it is important to compute the opportunity cost, which will then be subtracted from the net income.

-

2

The first thing to calculate is net income. For instance, if the company has made $100000 in revenues and incurred expenses in the region of $50,000, then the net income will be $50,000.

-

3

While net income is good for accounting purposes, the goal here is to calculate opportunity cost. To do that let’s suppose that an individual would have earned $50,000 had he decided to pursue a job in the banking industry rather than opting to start his own business, which earns him a profit of $50,000 as mentioned in step 2. His economic profit therefore will be zero as he had sacrificed $50,000 by turning down the employment offer.

-

4

For businesses, they usually determine economic profits by EVA. For that you will first need to calculate Net Operating profit After taxes (NOPAT). This will be done by adding back the taxes. Let’s suppose that NOPAT stands at $100.

-

5

Now calculate the total invested capital in the business. This will incorporate net working capital (Assets – Liabilities) and net fix assets. Assign it a value of $50. The next step is to add the hurdle rate and the risk rate together, which is referred to the minimum return you anticipate, plus the risk rate assigned to your business. Lets suppose that the percentage after adding both rates is 10. Multiplying the two will give you $5.

-

6

Now compute EVA. Subtract NOPAT with your capital cost to get economic profit, which in this case is $95 ($100-$5)