How to Calculate Debt Equity

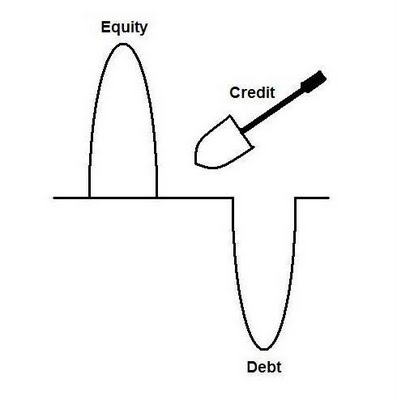

Debt to equity ratio is one of the most important ratios which are often calculated to evaluate the financial position of the company. It tells us about the financial structure of the company i.e. how much debt the company has taken from its creditors as compared to its capital which it has raised from its common stockholders. In short, it assesses how much risk the company has taken by taking money as loan and how stable it is due to its own capital. Furthermore, it is expressed as standard ratio or a percentage.

Instructions

-

1

First of all, you have to calculate the long-term debt of the company which includes loans, bonds and other line of credits. You can find this figure in the financial statements of a public limited company which are issued in its annual reports. However, if you are looking forward to find out the long-term debt of a private limited company, you will have to acquire its financial statements first.

-

2

Then, you have to determine the equity of the company. Equity includes the share capital, capital reserves and retained earnings of the company. You can easily find these figures in the financial statements of the public limited company, but for private limited company, you will have to acquire the financial statements by using a reference or request.

-

3

After getting both the figures, you can calculate the debt to equity ratio by dividing the long-term debt by the equity of the company. For example, if company has $2 million in debt and $4 million in equity, the ratio will be 1:2 which means for each dollar of debt, the company has 2 dollars of equity.

-

4

You can also express the debt to equity ratio as a percentage rather than as a standard ratio by just multiplying the ratio with 100. For example, if a company has $2 million in debt and $4 million in equity, the answer will be 50% (0.50 x 100). This indicates that for each dollar of equity, the company has fifty cents in debt.

-

5

After calculating the debt to equity ratio of a particular company, you have to compare it with the industrial average. Generally, financially sound companies have debt to equity ratio of around 1:1 or 100%.